Blog

That's the power of telling financial stories for children. And that's precisely what our workbook does: build financial habits from a young age so your child grows up confident, thoughtful, and financially aware.

La clave para la inteligencia financiera

Children don't just need to know how to spend wisely. They need tools to manage their emotions in the face of instant gratification.

Establishing a predictable weekly financial routine doesn't limit motivation: it quietly develops emotional regulation and discipline.

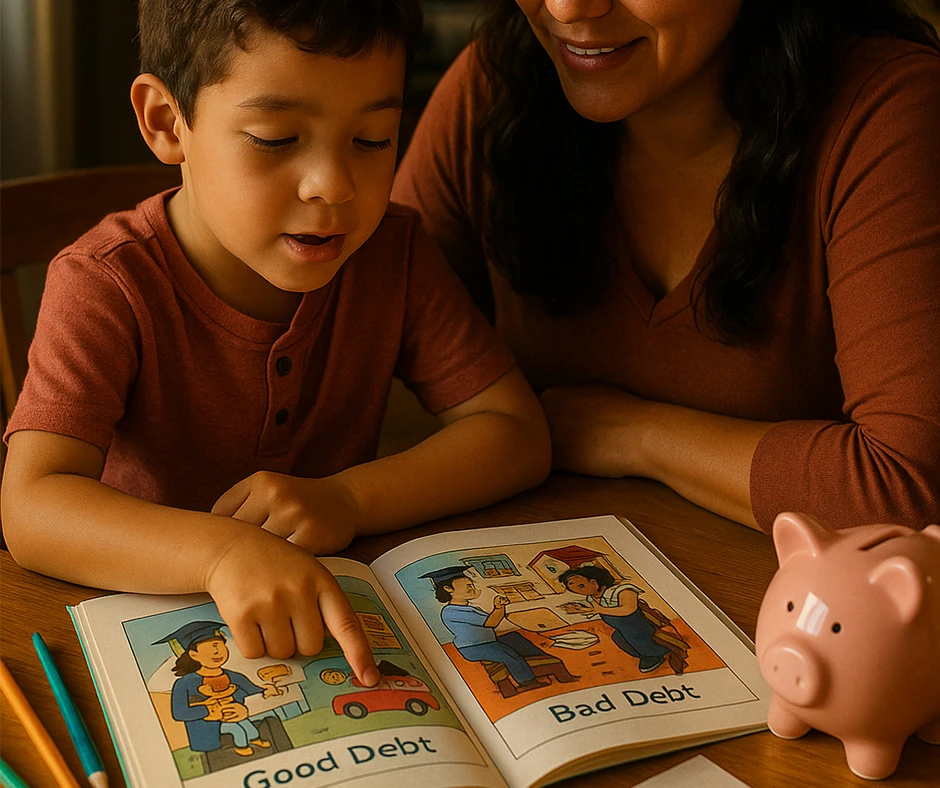

Debt isn't good or bad in and of itself. What makes it a positive or negative decision is the intention and purpose.

Many children don't have a problem with money; they have a challenge with emotional calm. It's built and practiced with printable financial activities.

The secret of financial games: how to teach financial education by playing without them realizing it

When a child plays, their brain creates deep connections. If the play involves sorting wants and needs, planning a budget, or avoiding impulse purchases, they're also learning financial literacy without even realizing it.

Does your child spend their allowance as soon as they receive it? It's not a lack of discipline—it's a lack of tools. Saving is a childhood financial skill that is developed early on with games, visual challenges, and educational stories.

What if your child’s future financial well-being at 30 starts with learning how to manage coins and bills at age 6? It does.

Child development experts and neuroscience agree: between ages 3 and 9, kids develop self-control, financial decision-making skills, and the ability to differentiate between a smart investment and an impulsive whim.

More than giving them material objects, the most valuable thing is teaching them to make smart decisions about money from a young age. Early financial education isn't just a subject: it's a life skill.

And the best part: you can start today, without complicated formulas, with fun financial activities, stories, and everyday decisions that build positive financial habits.