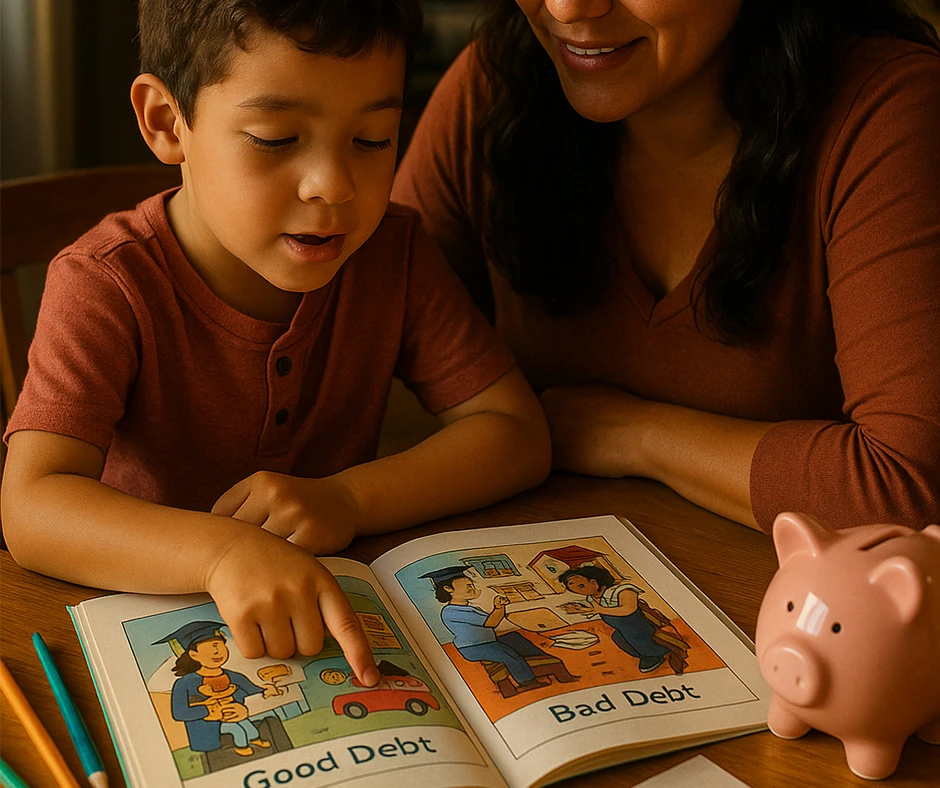

How to Teach Children Good and Bad Debt about Sound Financial Decisions

Debt isn't good or bad in and of itself. What makes it a positive or negative decision is the intention and purpose.

“Money doesn't change people. It only amplifies what's already inside.” — Will Smith

Debt isn't good or bad in and of itself. What makes it a positive or negative decision is the intention and purpose.

Why teach children about debt from an early age?

According to the CFPB, teaching responsible debt from age 6 improves adolescent self-reflection and prevents impulsive borrowing in adulthood.

Key Activity: “Good Debt vs. Bad Debt” (page 14)

Your child will analyze four illustrated mini-stories and decide whether borrowing makes sense based on the goal, timing, and consequences. With colors and your guidance, they'll understand that it's not just about avoiding debt, but also about thinking with their head and heart.

Backed by science

The American Economic Association notes that practicing decisions with symbolic money improves financial self-regulation in adulthood.

What your child learns… and how you'll see it at home

| What your child learns | What you observe |

| That not all debt is negative | Less impulsiveness and more reflection |

| Think before you decide | Greater security in your judgment |

| Help with healthy boundaries | Empathy with responsibility |

| Choose wisely | Less arguments over unnecessary purchases |

Closing: True courage lies in making conscious choices. Use page 14 of the “Be a Real Hero” workbook. A 10-minute conversation today can change your relationship with money forever.